OnePlus Emerges as Premium Android Smartphone Brand of Choice in India as per Techarc Premium Smart Tech Survey

In a study conducted by Techarc among the premium Android users, it was found that the trend towards building a smart tech lifestyle is getting stronger. Users are buying multiple devices with the smartphone being the hub, while smart TV, TWS Earbuds and Smart Watch, the other three key devices defining this lifestyle. There is also incremental increase seen in adoption of other smart home devices that are gradually adding to a holistic, smart, and premium experience. Figure 1: Aspirational Premium Android Smart Tech Brands Sharing the key insights, Faisal Kawoosa, Chief Analyst at Techarc said, "In the premium segment, overall experience and pedigree of the brand are as important as the features and specifications being offered. Over the years, OnePlus has balanced all these critical aspects well, earning itself the aspirational value within the Android ecosystem." "Today, premium users are willing to trust OnePlus in other devices like Smart TV and TWS Earbuds recognising its performance in smartphones. However, it should focus additionally on Smart Watch. Additionally, while Samsung maintains its incumbent stature, Xiaomi is a new entrant in the zone," added Faisal. The research further said that 2 out of every 3 premium users surveyed consider seamless connectivity among these devices extremely critical in delivering the desired experience. The premium users appreciate these devices being able to 'talk' to each other for which they should not be required to do a pro-level effort or buy some additional hardware / accessory. At the same time, the connectivity which is centred around smartphones should be extremely user friendly to leverage. Figure 2: Premium Users connecting to other Smart devices Key Highlights of the Report: Premium Smart Tech Lifestyle Users in this segment are primarily brand conscious and strongly consider the brand of the device in the premium category. Across all the devices, more than 1 of every 3 users find brand name as an important factor helping them to ascertain the premium outlook of a brand. OnePlus has positioned itself as a premium brand without any dilution since its inception, compared to Samsung which is spread across segments catering to different user groups. The new brand in the zone, Xiaomi also has a similar challenge to overcome. 2 out of 3 premium users consider seamless connectivity as a critical factor in delivering the desired experience. This is because of the fact that premium users want anytime, anywhere, any device kind of experience which can only be achieved by seamless connectivity of these gadgets to share content as well as control other devices. Other than the brand being premium in terms of positioning, the preference of users in this segment is to buy from the brands which are also able to offer the best quality along with top-notch features and specifications. For this reason, brands that have specialisation in respective products are purchased more than those that are only tagged as 'premium'. The premium users are primarily buying devices through online channels. In the offline medium, there is a growing preference for brand exclusive retail stores. While traditional use cases of the smart devices continue to be the dominant applications, interactive and immersive use cases are catching up fast in the premium segment. Smartphones 58% of the premium users use their smartphones for video content and applications making it the top use case by applications in the segment. While all the key brands have attempted to improve the performance for video, OnePlus is seen as proactively capturing the pulse of the users by introducing phones with specifications like 120Hz refresh rate, fast charging and higher aspect ratio to encourage video consumption with immersive experience. By brands, 62% of OnePlus users consume video apps and content, the highest of any premium brand. Among the top three premium smartphone brands, OnePlus has the highest contentment rate (88%) followed by Xiaomi (83%) and Samsung (81%) in that order. Users appreciate the overall performance as the top factor in deciding their contentment with a premium smartphone. Brand of the smartphone tops the factors that define premium for users with 38% of the respondents considering it as the key factor, followed by features and specifications at 26%. The Indian consumer in the premium segment is value conscious and appreciates brands offering longer shelf life. Among the premium brands, 19% of the OnePlus users use the same model for longer durations followed by a tie between Samsung and Vivo both at 17%. 82% of the respondents had purchased their premium smartphone from online channels with ecommerce marketplaces contributing to 82

In a study conducted by Techarc among the premium Android users, it was found that the trend towards building a smart tech lifestyle is getting stronger. Users are buying multiple devices with the smartphone being the hub, while smart TV, TWS Earbuds and Smart Watch, the other three key devices defining this lifestyle. There is also incremental increase seen in adoption of other smart home devices that are gradually adding to a holistic, smart, and premium experience.

|

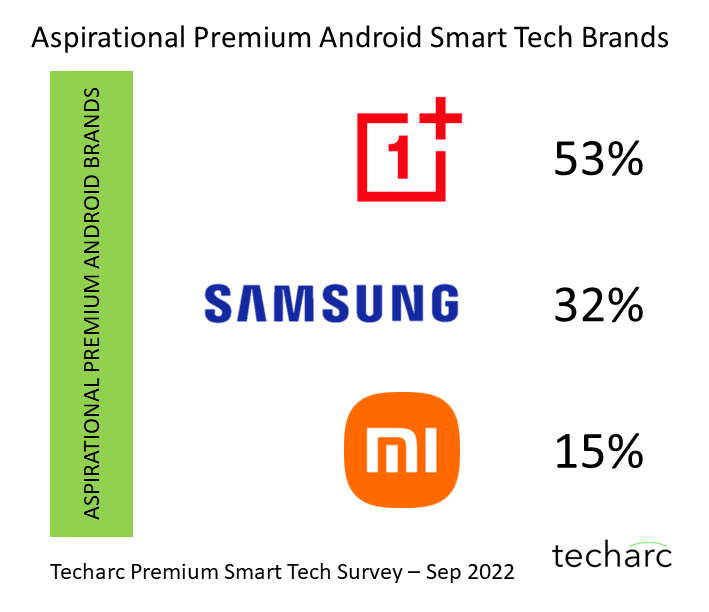

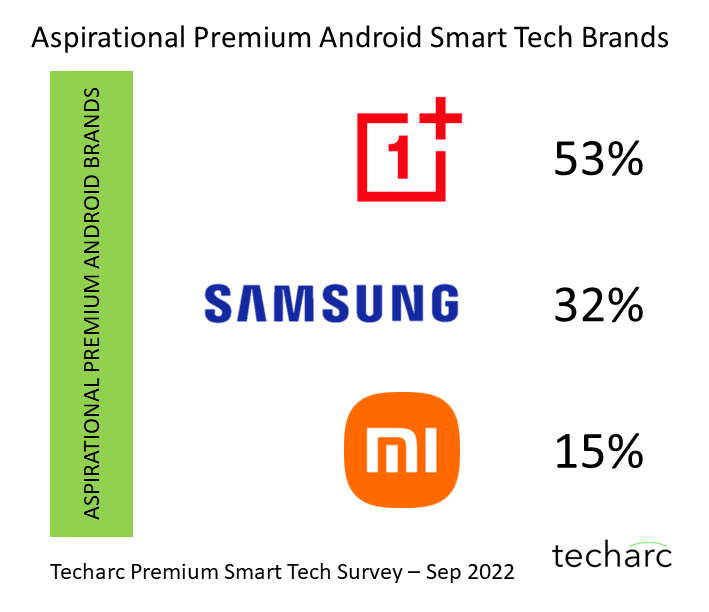

Figure 1: Aspirational Premium Android Smart Tech Brands

Sharing the key insights, Faisal Kawoosa, Chief Analyst at Techarc said, "In the premium segment, overall experience and pedigree of the brand are as important as the features and specifications being offered. Over the years, OnePlus has balanced all these critical aspects well, earning itself the aspirational value within the Android ecosystem."

"Today, premium users are willing to trust OnePlus in other devices like Smart TV and TWS Earbuds recognising its performance in smartphones. However, it should focus additionally on Smart Watch. Additionally, while Samsung maintains its incumbent stature, Xiaomi is a new entrant in the zone," added Faisal.

The research further said that 2 out of every 3 premium users surveyed consider seamless connectivity among these devices extremely critical in delivering the desired experience. The premium users appreciate these devices being able to 'talk' to each other for which they should not be required to do a pro-level effort or buy some additional hardware / accessory. At the same time, the connectivity which is centred around smartphones should be extremely user friendly to leverage.

|

Figure 2: Premium Users connecting to other Smart devices

Key Highlights of the Report:

Premium Smart Tech Lifestyle

-

Users in this segment are primarily brand conscious and strongly consider the brand of the device in the premium category. Across all the devices, more than 1 of every 3 users find brand name as an important factor helping them to ascertain the premium outlook of a brand. OnePlus has positioned itself as a premium brand without any dilution since its inception, compared to Samsung which is spread across segments catering to different user groups. The new brand in the zone, Xiaomi also has a similar challenge to overcome.

-

2 out of 3 premium users consider seamless connectivity as a critical factor in delivering the desired experience. This is because of the fact that premium users want anytime, anywhere, any device kind of experience which can only be achieved by seamless connectivity of these gadgets to share content as well as control other devices.

-

Other than the brand being premium in terms of positioning, the preference of users in this segment is to buy from the brands which are also able to offer the best quality along with top-notch features and specifications. For this reason, brands that have specialisation in respective products are purchased more than those that are only tagged as 'premium'.

-

The premium users are primarily buying devices through online channels. In the offline medium, there is a growing preference for brand exclusive retail stores.

-

While traditional use cases of the smart devices continue to be the dominant applications, interactive and immersive use cases are catching up fast in the premium segment.

Smartphones

-

58% of the premium users use their smartphones for video content and applications making it the top use case by applications in the segment. While all the key brands have attempted to improve the performance for video, OnePlus is seen as proactively capturing the pulse of the users by introducing phones with specifications like 120Hz refresh rate, fast charging and higher aspect ratio to encourage video consumption with immersive experience. By brands, 62% of OnePlus users consume video apps and content, the highest of any premium brand.

-

Among the top three premium smartphone brands, OnePlus has the highest contentment rate (88%) followed by Xiaomi (83%) and Samsung (81%) in that order. Users appreciate the overall performance as the top factor in deciding their contentment with a premium smartphone.

-

Brand of the smartphone tops the factors that define premium for users with 38% of the respondents considering it as the key factor, followed by features and specifications at 26%.

-

The Indian consumer in the premium segment is value conscious and appreciates brands offering longer shelf life. Among the premium brands, 19% of the OnePlus users use the same model for longer durations followed by a tie between Samsung and Vivo both at 17%.

-

82% of the respondents had purchased their premium smartphone from online channels with ecommerce marketplaces contributing to 82% of these purchases. Among offline channels, brand-owned stores lead with 43% of the total offline sales.

Smart TV

-

30% of the premium smart TV users use it for OTT apps indicating that it is primarily still used as a unidirectional device.

-

Interactive applications like gaming and video calls are emerging as the new use cases of Smart TVs. For these the premium smart TV users shall have to recalibrate the device and make it an interactive Smart TV alongside enhancing the immersive experience.

-

While Brand tops with 34% respondents feeling it being the reason to feel premium, 18% of the respondents felt that audio-visual experience is a factor defining the premium orientation of the Smart TVs.

-

The market incumbent Sony continues to be the aspirational brand here for 26% of the respondents. Interestingly, OnePlus features as the 2nd aspirational smart TV brand in the premium segment with 22% respondents voting it as their desired smart TV brand.

-

Among the brands considered to be offering longer model shelf life, Samsung leads with 23% of the premium smart TV users opining for it.

-

OnePlus is the only premium brand in the smart TV segment along with the TV incumbents like Sony, LG and Samsung. Although Redmi is also used by around 13% of the premium users, the brand isn't considered as a premium brand in the smart devices' ecosystem.

-

78% of the respondents surveyed had purchased their smart TV from an online marketplace, while 45% of those purchasing it offline, preferred the Large Format Retail (LFR) stores where they could experience across several brands.

TWS Earbuds

-

With TWS becoming a very fragmented market spread across a range of price points, the brand is the main factor that determines whether the wearable is premium or not. 38% of the respondents think of brand as the key factor.

-

Other than the overall quality and the price, comfort of wearing a TWS also defines about the premium feel of the wearable. 14% of the respondents attributed comfort as a factor defining premium in TWS buds.

-

OnePlus and Samsung are the two aspirational TWS Earbud brands with 14% respondents each voting for them. It is followed by JBL at 11%.

-

Among the premium brands, OnePlus Buds are considered to be offering longer shelf life with 25% respondents feeling the same. This is followed by JBL and Samsung at 17% and 13% respectively.

-

92% of the respondents surveyed in the premium category had purchased their TWS earbuds from online mediums. Among these 91% had bought it from an online marketplace. In the offline space, 52% of the respondents had purchased it from a Large Format Retail (LFR) store.

-

With the features cascading rapidly in lower segments of TWS earbuds, the premium brands shall have to look for faster innovations that could be sustained in this category for considerable duration so that users find tangible reasons to go premium in this category other than the audio quality offered in this segment.

Smart Watch

-

The Smart Watch is primarily used for notifications and reminders in the premium segment. 34% of the respondents viewed this as their primary use case. Other use cases of a Smart Watch included fitness tracking, communication apps and music in that order. With smart home and IoT devices starting to penetrate in our homes and offices, the smart watch is also seen as a handy gadget to control them. 11% of the respondents used their smart watches to control devices such as their smart tvs.

-

Brand of the smart watch plays a key factor in defining it as a premium category watch. 15% of the respondents do consider looks and design a factor in making a smart watch appear premium.

-

Samsung, Garmin and Fossil are the three main premium smart watch brands. Other premium brands like OnePlus show a relatively scarce presence, however, is considered as a premium offering by the users.

-

95% of the smart watches were purchased online of which 68% of the users had owned their smart watch through an online marketplace. In the offline space, more than half (52%) preferred buying through brand exclusive stores. This indicates brands have a strong preference about smart watches and go for a particular brand which they can find at its retail store.

About the Survey

The survey administered through online mode was done about 1500 premium android users of 4 key smart tech products of smartphone, smart TV, TWS earbuds and smart watch. A structured questionnaire was designed to capture views from users owning a smartphone of Rs 25,000 or above. The study was conducted among fairly distributed sample representing a blend of socio-economic profile dwelling in metro (62%) and non-metro (38%) cities and towns.

![]()